Banking’s New Race: Using AI to Steal Your Rival’s Best Customers

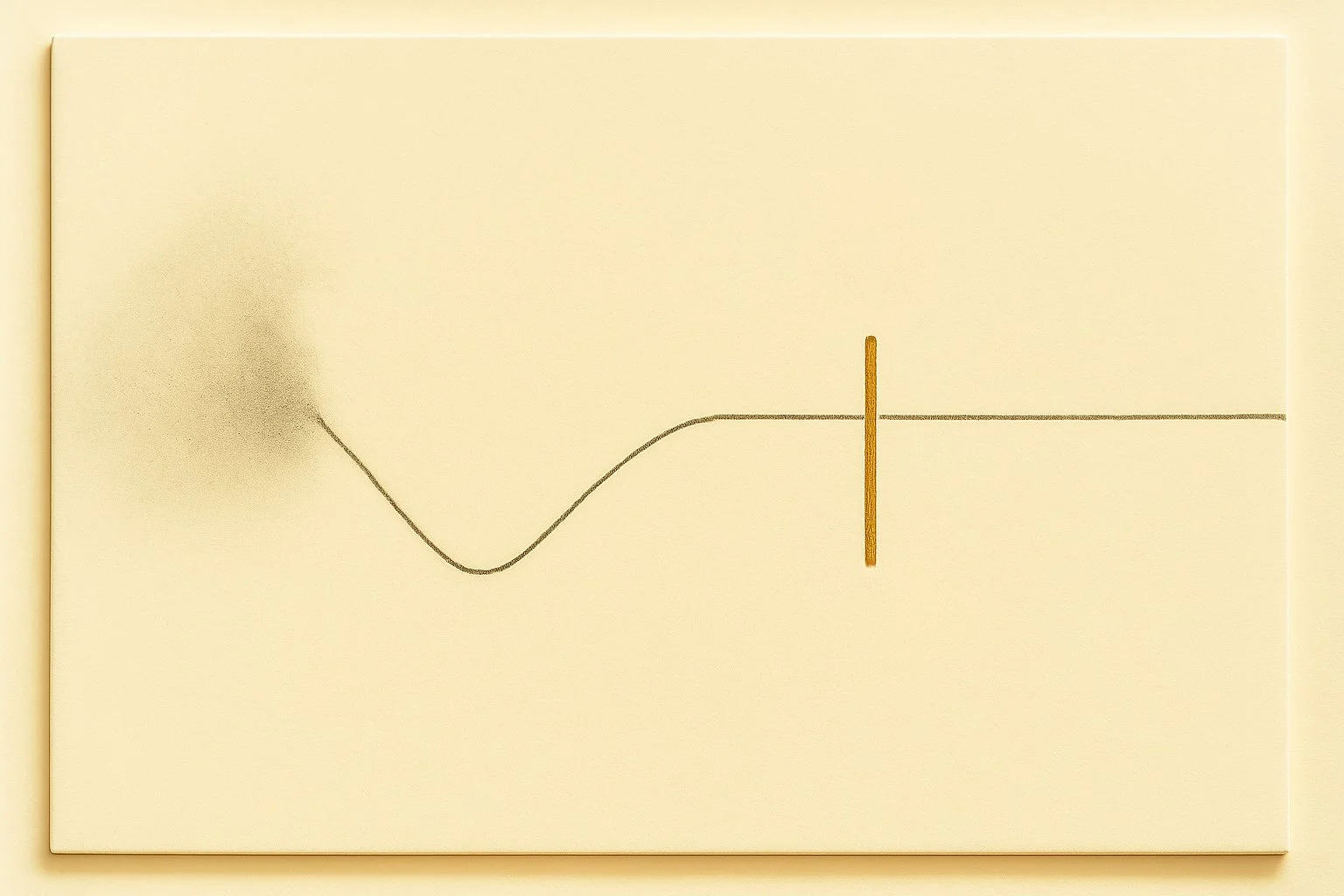

Most banks are using AI like a digital air-freshener: to slightly improve products, tweak client support and maybe slow down churn. Meanwhile, the real game has already moved.

Facing ‘fluid’ SMEs who switch easily and aggressive fintechs, most banks are still stuck in defensive mode – polishing apps, matching competitors’ rates a quarter too late, and hoping brand heritage will carry them. It won’t! The uncomfortable shift is this: AI is a magnificent raid tool to attack your competitors’ base!

Auditors Missed a “Breathtaking” $500M Fraud! Here Is How AI Would Have Caught It

In late 2025, a telecom entrepreneur pulled off what lenders described as a “breathtaking” fraud — and he did it right under the noses of expert auditors. For years, no one saw it. The lenders only began asking questions in 2025, after things started to smell off. By then, it was too late: lawsuits were already flying, and the cash was gone! Could an AI-Process Have Caught It? Absolutely! — Here’s How

KYC/KYB Took Banks Years to Streamline. Now "KYA" Is Here: Recognize AI Agents, Update T&Cs, or Lose the Transaction

AI-driven agentic commerce—where autonomous agents shop on behalf of customers—is fast breaking the assumptions behind banks’ KYC/ KYB controls. Payment systems built for human-initiated purchases are suddenly blind to who (or should I rather say “what”) is actually pressing “BUY.” The new strategic mandate for Banks and Payment Service Providers is KYA: “Know Your Agent”.

The Fragile AI Outsourcing Trap: Why Smart Banks Are Building, Not Buying

What if the “AI startup vendor” powering your bank’s shiny new product is actually a fragile middleman sitting on a ticking economic time-bomb? Generative AI is hailed as the biggest productivity leap since the internet. Yet beneath the hype lies a hidden vulnerability: most AI startups your business hires may not be building anything new…

From Cash to Cards to AI Agents: Google just announced AP2 - the New Rulebook for 'Autonomous' Commerce payments!

Google announced a couple of days ago, the Agent Payments Protocol (AP2), an open standard that fixes a basic flaw in today’s commerce checkout: systems assume that a human clicks the “BUY” button. Yet AI agents are increasingly doing the deciding!

Banks' Blind Spot: Marketplaces Are Winning Lending — The Counterplay Starts With AI

Marketplaces are quietly becoming lenders and "owning" the loan funnel. This issue discusses how banks could win it back with instant, transparent credit decisions powered by AI — plus offers the rails of a plan to partner at checkout, scale safely, and keep the margin.

Cash or Cards? Digital Euro? Account-to-Account? — By 2030 None Will Win (hint: Your AI Wallet Will)

Cards. Cash. Local payment schemes. Account-to-Account payments. Digital Euro. Everyone’s still arguing over which rail will dominate payments in Europe by 2030. But here’s the inconvenient truth: None of them will!

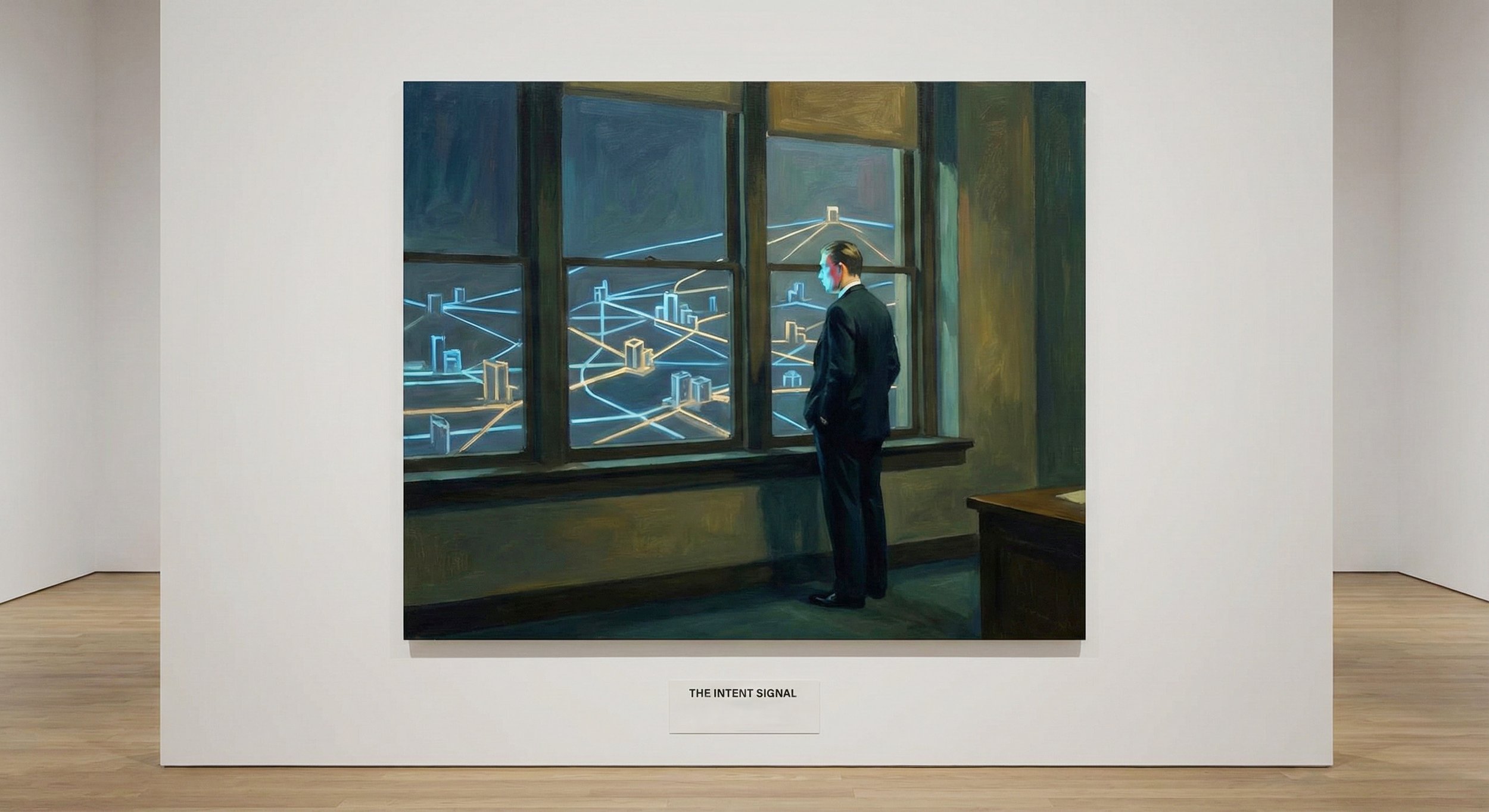

AI is not an “Automation Tool”. It is a new Strategic Operating System for Financial Institutions

Banks and financial institutions face a simple choice:

Treat AI as one more automation tool — or rebuild their entire operating system for speed, compliance, and long-term advantage. In this issue, I outline why AI must be treated as a Strategic Operating System — and how leadership, regulation, and architecture must shift together.